Ultra-Enhanced Income

Our Ultra-Enhanced Income Strategy is our conservative, fixed income-based collaborative effort, offering unprecedented returns within its respective risk-class.

The Wealth Quorum®, in cooperation with our colleagues at MG Asset Management, have co-developed our Ultra-Enhanced Income Strategy.

This pioneering strategy is our conservative, fixed income-based collaborative effort, offering unprecedented returns within its respective risk-class.

This solid and reliable income strategy also places a strong emphasis upon our newly conceptualized “in and out” method. This revolutionary system is designed to optimally navigate market ups and downs and significantly reduce volatility and drawdowns.

This strategy is available to both our individual and professional Members and offers unprecedented flexibility and customization. Members who wish to participate will enjoy the ability to employ unlimited levels of capital that can best suit their needs, coupled with some of the most competitive fees available in the industry. Individual Members may choose to have their accounts executed through any of our growing network of top custodians, including leading companies such as Schwab and Interactive Brokers. We are in the process of rapidly expanding these choices to offer our Members maximized convenience. In addition, professional Members have the option of receiving signals directly from us so they can execute their transactions through any custodian of their choice.

THE COMPONENTS

Ultra-Enhanced fixed income returns are achieved in this strategy with the assistance of several outside veteran fixed income managers (Clearstead and Boyd Watterson) with combined assets under management (AUM) of over $50 billion (USD).

These managers have extensive experience managing high yield disciplines. These investments include high yield, corporate and short duration ETFs as well as limited short duration higher yielding corporate bonds.

Depending on the level of assets employed, Members will have direct access to manager inputs. All of the inputs are specifically designed to be tactical and take full advantage of bond markets that are trending positive while principally including high-yield bonds with different levels of duration.

Each input from a respective manager uses ETFs except for one manager who offers their strategy in a mutual fund. The ETF inputs employ a timing system and may make intra-month adjustments to shorten or lengthen the high yield exposure and duration.

During rising interest rate markets when owning these fixed income assets are undesirable, the assets of the ETFs will be moved into money markets or a similar, shorter duration fixed income ETF. The systems are carefully designed to preserve capital in unattractive fixed income markets.

When invested, any of the manager’s inputs are generating at least a 6% annual yield. The average duration for this strategy is no longer than 5 years and, in most cases, may average 3 years for the entire portfolio. The lowest quality of the Bond ETFs is BBB (or better).

This is a total return strategy, and over rolling 3 to 5-year periods, has shown consistent outperformance of at least 300 to 400 basis points "above" the Bloomberg Aggregate Bond Index over a rolling 12-month period.

These are active strategies, but only average 1-2 transactions a month unless we get into a very negative bond market in which case, they may require additional activity.

Finally, returns are even further enhanced with the addition of algorithmic models that manage short-term, low-volatility equity exposure.

Multi-Manager, High Income (and High Alpha) Portfolios

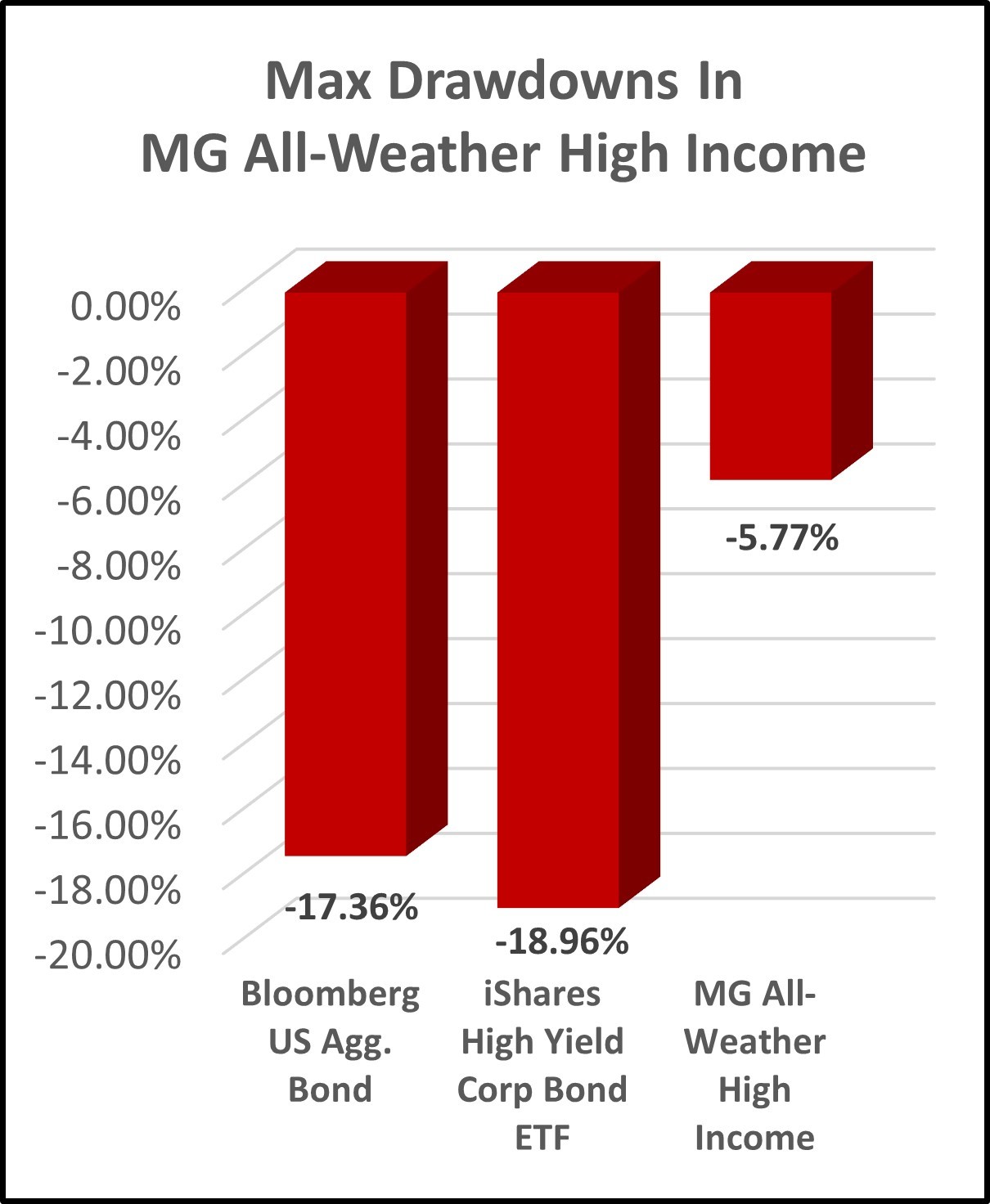

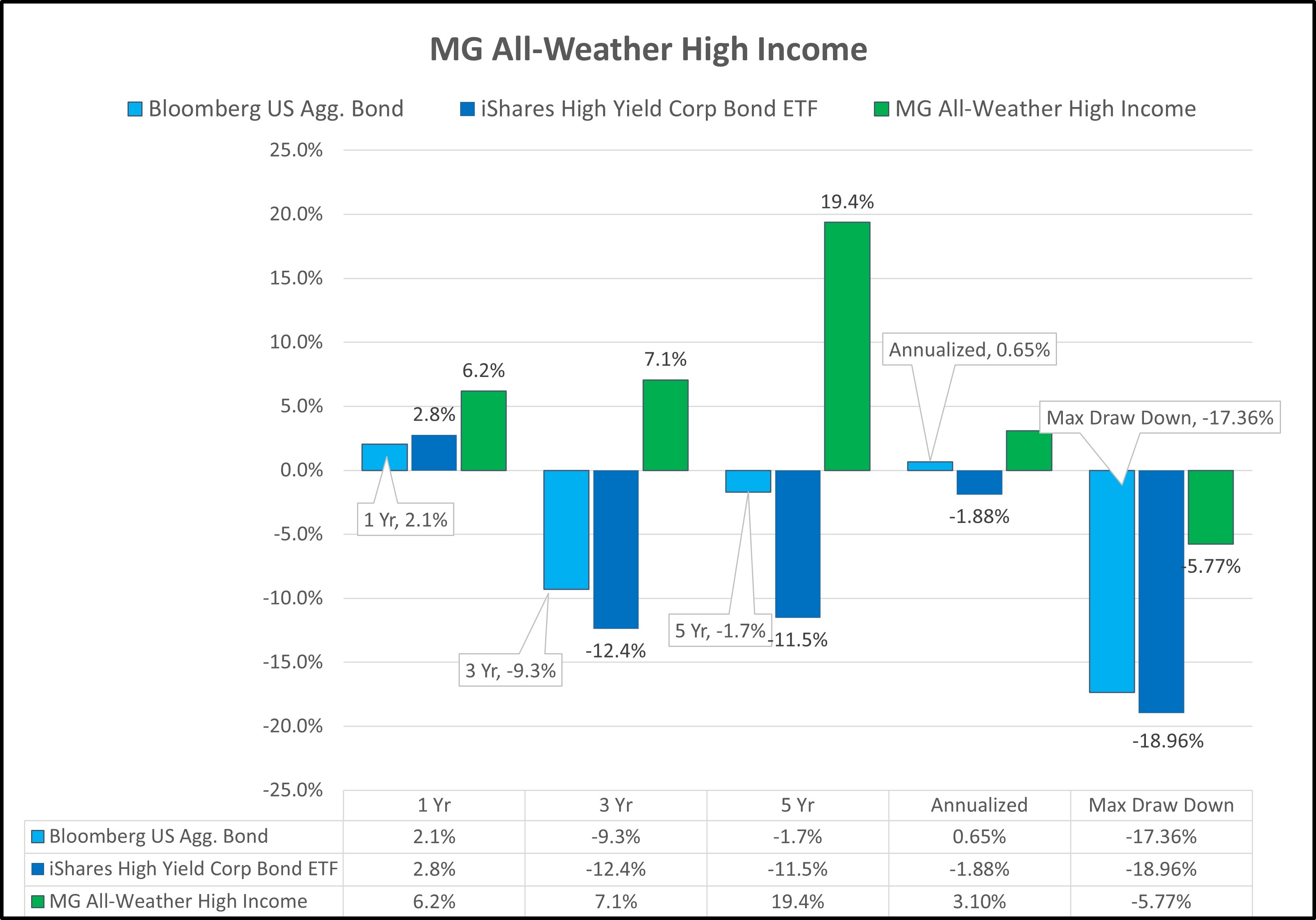

There are three tiers of strategies with escalating opportunities for exposure for increased yields. All three tiers have substantially higher historical returns and lower maximum drawdowns than their benchmarks.

- MG All-Weather High Income Portfolio Blend

- MG Tactical High Yield Portfolio

- MG All-Weather Enhanced High Income Portfolio Blend

MG All-Weather High Income Portfolio Blend

The MG All-Weather High Income Portfolio Blend combines the strategies of three dynamic, seasoned and flexible (tactical) income managers (Boyd Watterson, Clearstead Advisor Solutions and MarketGaugePro Investment Solutions). As a result, this portfolio offers exposure to a diverse group of assets, such as individually traded fixed income securities, asset-backed and floating rate securities, individual corporate fixed income securities, collateralized loan obligations, and a wide array of fixed income ETFs including high yield, easily tradeable and performance driven ETF strategies.

The Boyd Watterson allocation is traded via an institutional fund. The Clearstead Advisor Solution piece, highly tactical and defensive, is traded via a multitude of fixed income and cash equivalent ETFs. The MarketGaugePro (MG Tactical High Yield) strategy, driven by two separate algo engines is highly tactical and will typically hold 2-4 different higher yielding fixed income ETFs based on MarketGaugePro models.

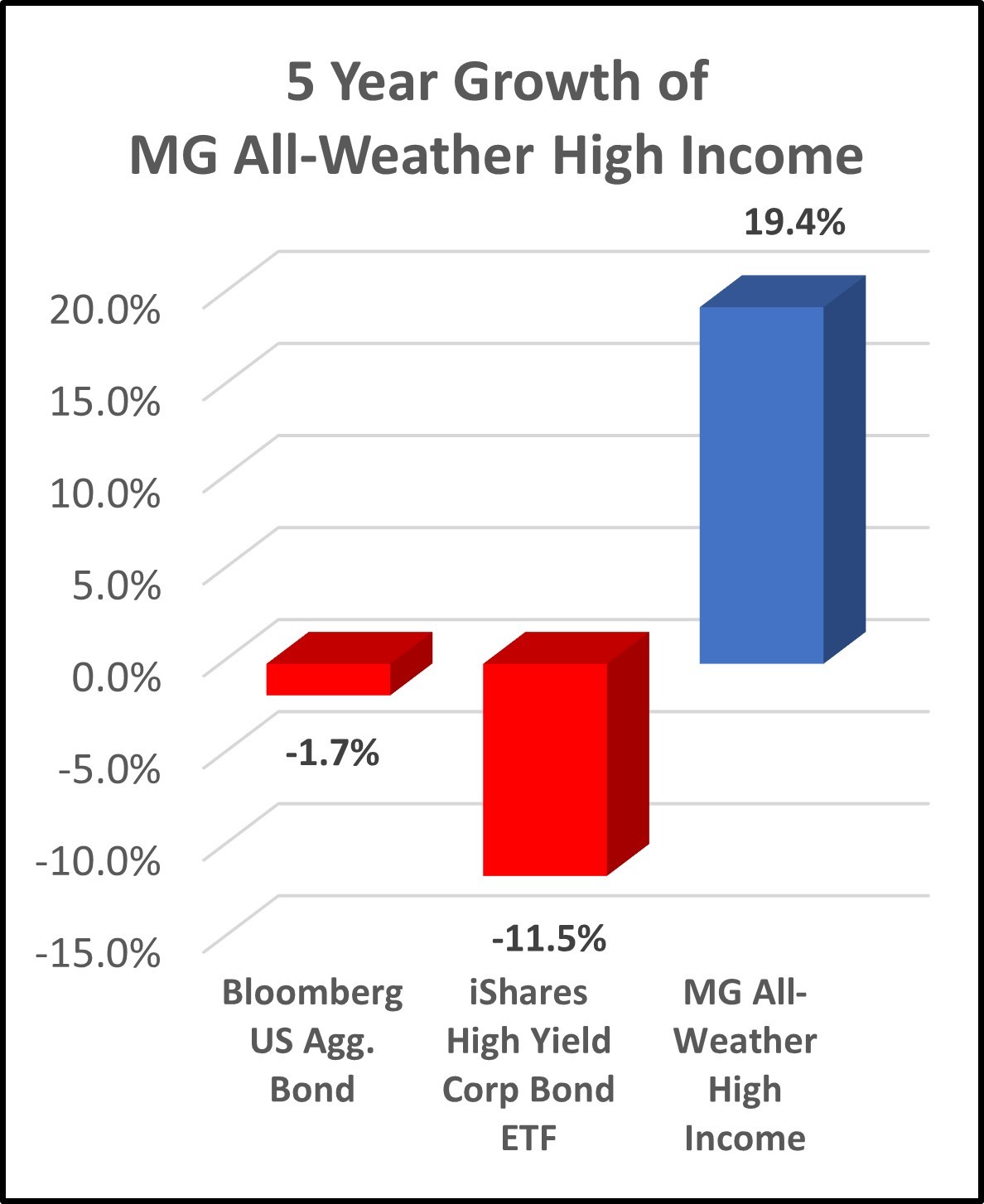

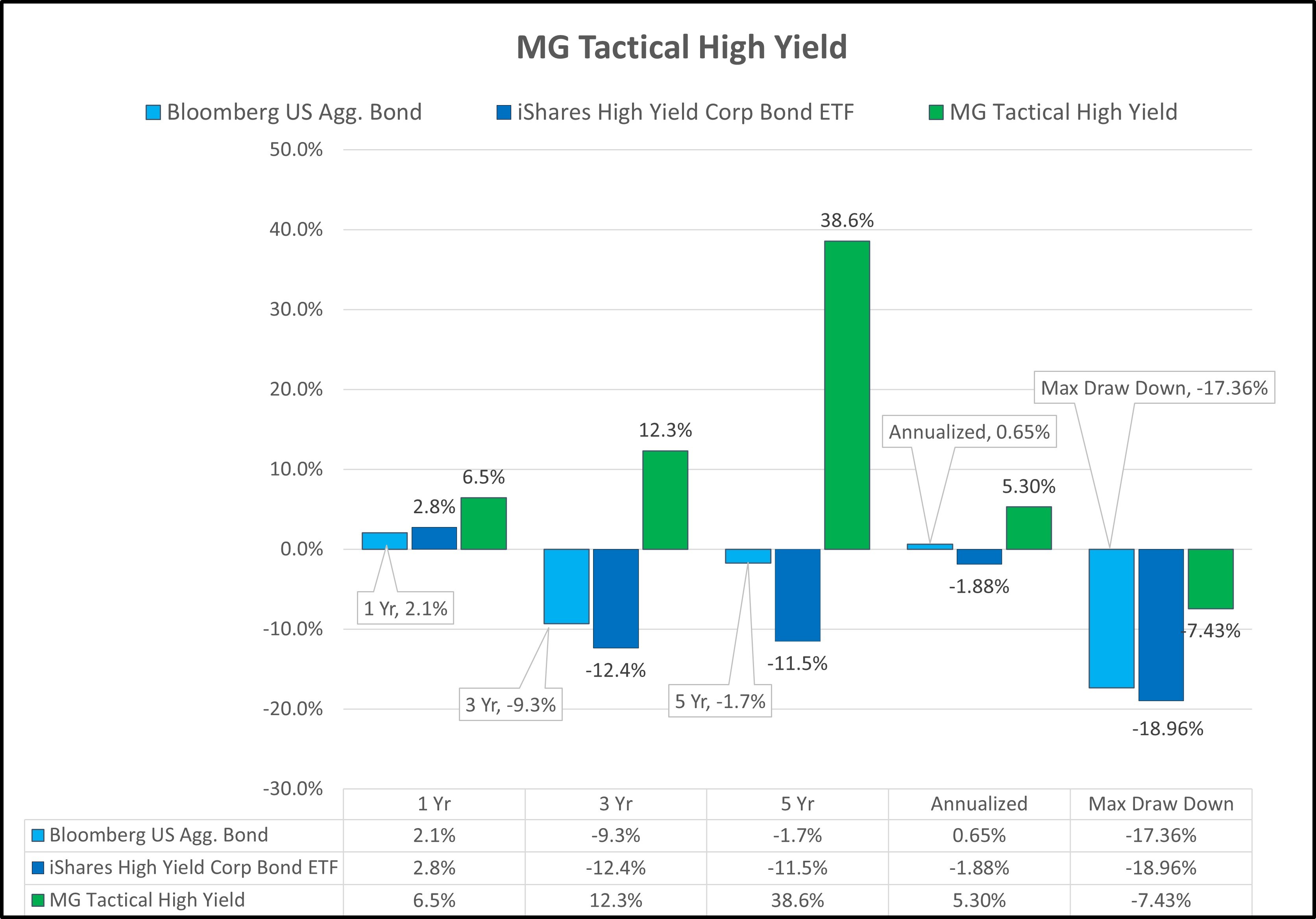

The MG All-Weather High Income Portfolio Blend utilizes all three managers’ dynamic individual strategies (Multi-Manager) and together has produced annualized returns over the 1, 3 and 5 year time periods well in excess of the relative fixed income benchmarks.

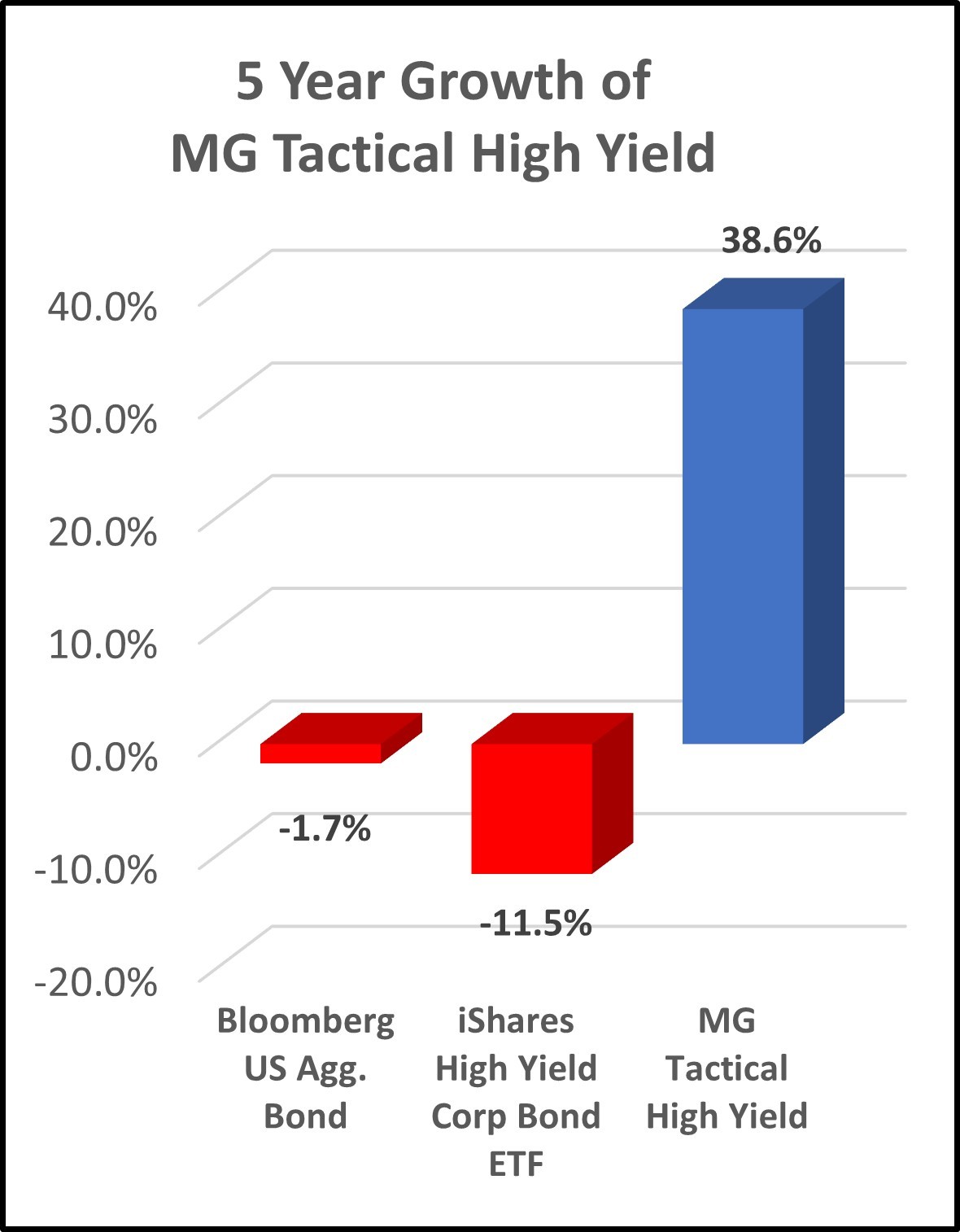

MG Tactical High Yield Portfolio

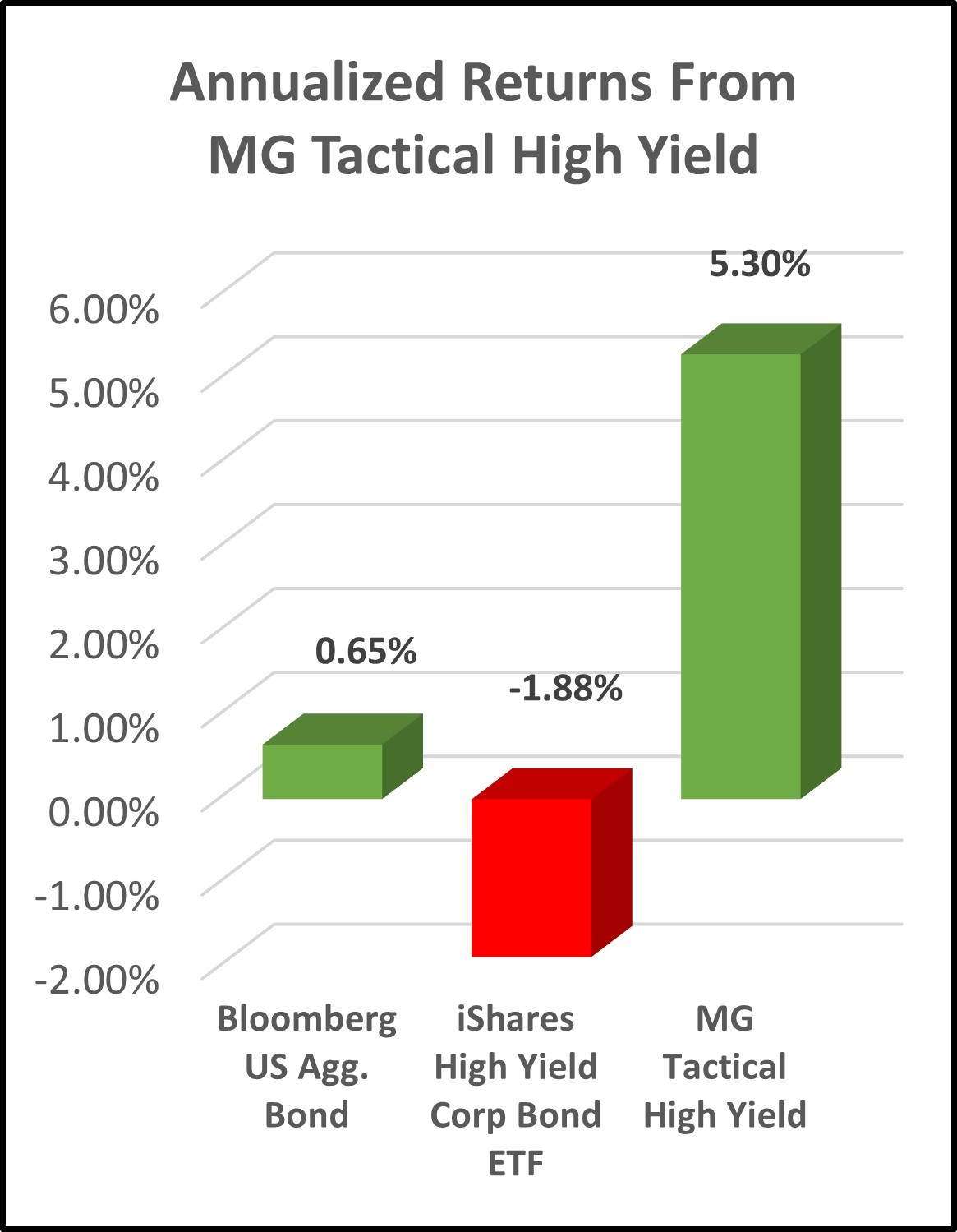

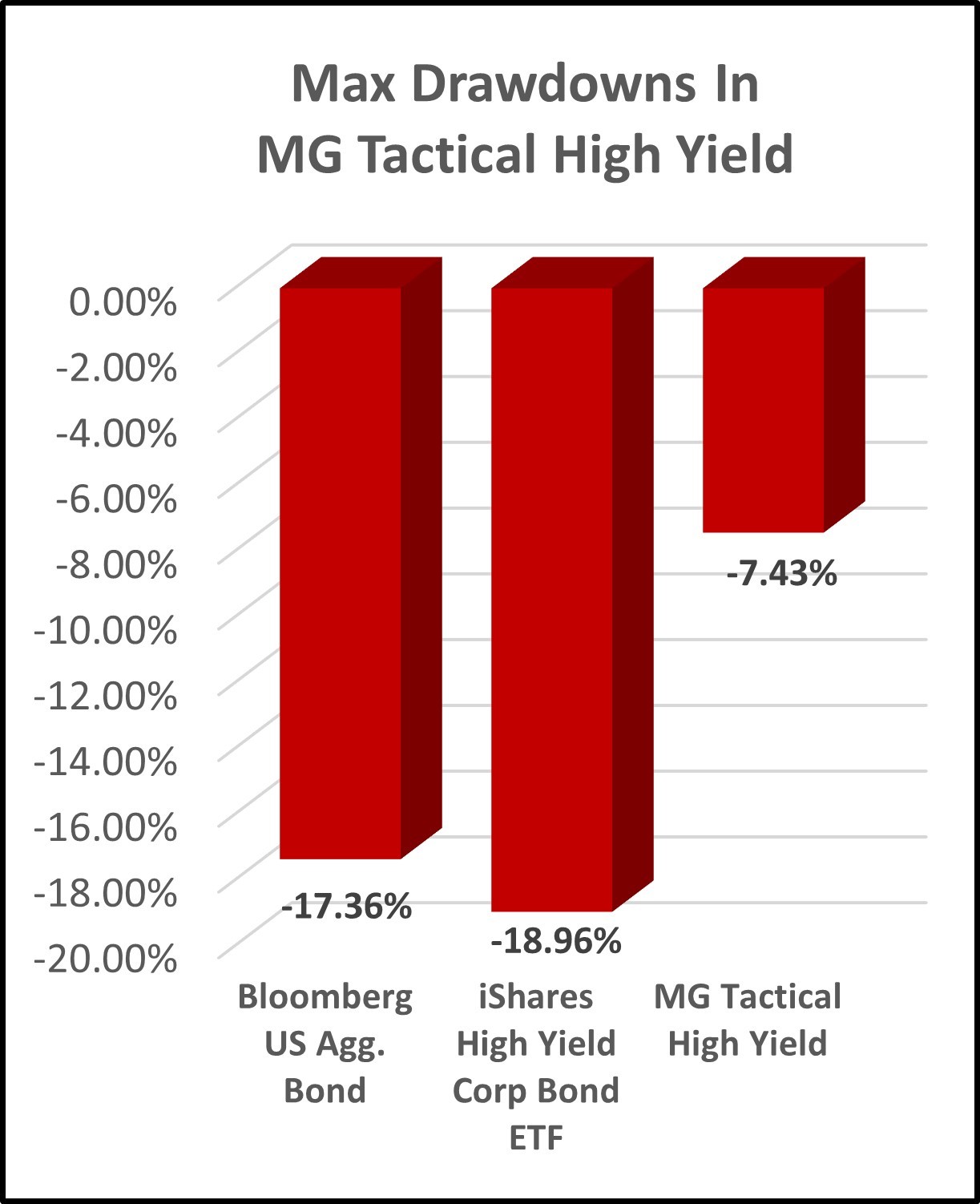

The MG Tactical High Yield Portfolio utilizes MarketGaugePro’s rules-based and formulaic algorithms to determine “risk on” or “risk off” conditions of the high yield income markets and then trades high yield ETFs to exploit short and intermediate-term trends. The use of high yield ETFs offers the potential for higher returns, and MarketGaugePro’s risk managed trading tactics keep the drawdowns low.

Difficult fixed income markets, especially those we have experienced the last few years with rising interest rates, can have a detrimental impact on fixed income accounts by the inverse activities of yield and principal. The MG Tactical High Yield Portfolio by design prioritizes capital preservation in difficult fixed income markets. This is exhibited by much lower drawdowns than the traditional fixed income manager or widely used bond mutual fund.

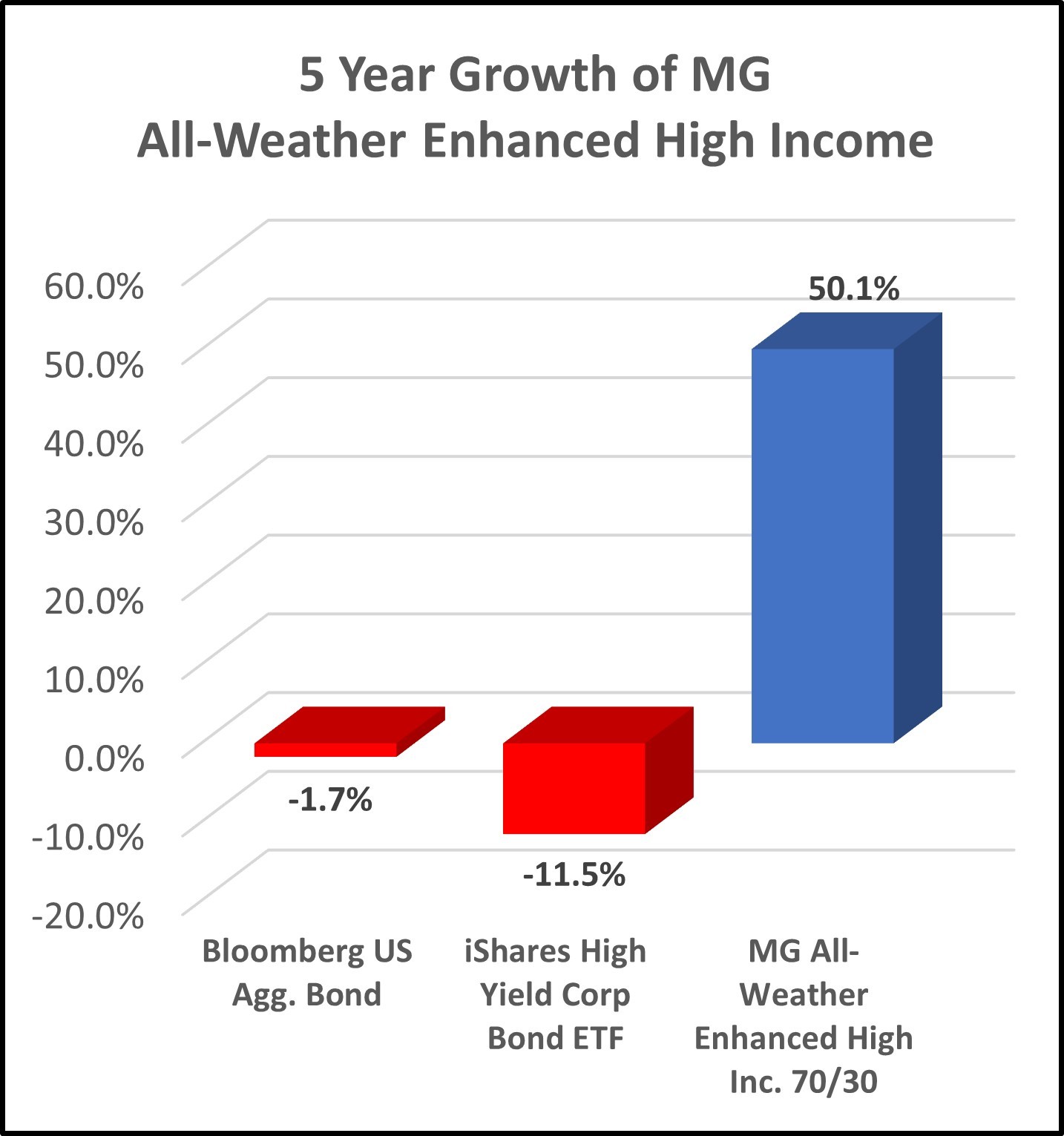

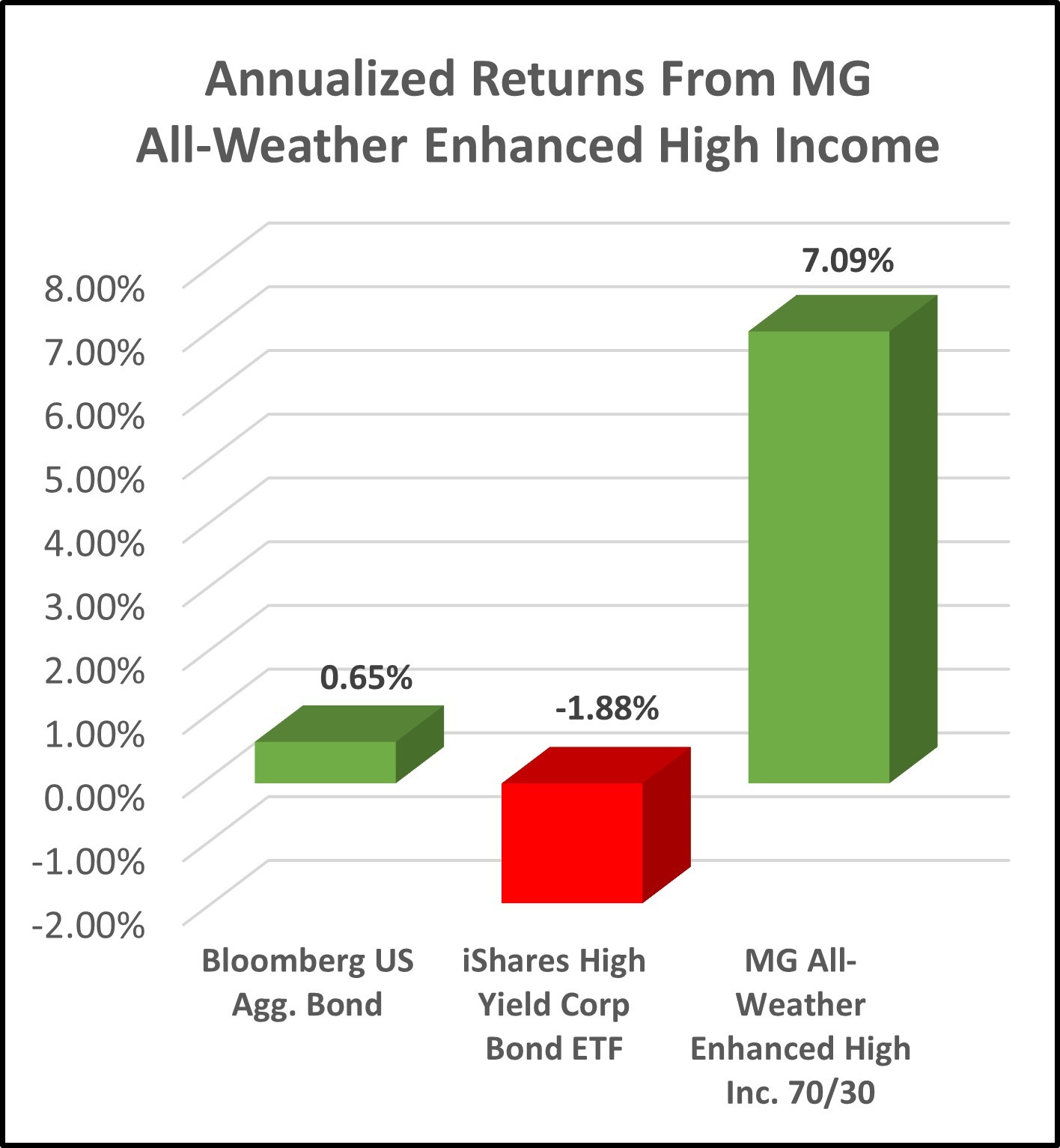

MG All-Weather Enhanced High Income Portfolio Blend

The MG All-Weather Enhanced High Income Portfolio Blend increases total return, and alpha by combining the MG Tactical High Yield strategy with additional lower-risk equity strategies including the Tactical Core Equity Strategy. The end result is a predominantly fixed income orientation with a high Alpha driver that has portfolio characteristics very favorable against fixed income benchmarks with far less drawdowns and meaningful added value. Depending on the objective of the fixed income account, MarketGaugePro has developed a methodology to enhance the Fixed Income portfolio with exposure of 10% to 30% low risk equity exposure as referenced in the charts below:

THE ONBOARDING PROCESS

The very first step in the process is to contact us directly and schedule a brief consultation directly with our Managing Director, Clayton Anderson. During this brief call, it will be determined which onboarding process is likely most suitable for your needs. Mr. Anderson will then refer you directly to our team of onboarding professionals who will carefully examine your unique situation and guide you through the remainder of the process in the most seamless and expedited fashion possible.

Individual Investors will be seamlessly guided through a simple 3-step onboarding process.

1) First, a consultation will be scheduled with one of our registered investment advisors with our partners at MG Asset Management. During this consultation, your advisor will help you both determine and confirm your suitability for your desired strategy selection. Your advisor will then help you determine the optimal options for who will serve as the designated custodian for your assets. This could include an existing relationship you already have established or one that your advisor suggests. Your advisor will then prepare and explain all the necessary agreements to establish the relationship between yourself and MG Asset Management.

2) Second, your advisor will prepare, explain and execute all the necessary agreements between yourself, the custodian of choice and MG Asset Management.

3) Finally, your advisor will begin professionally managing your assets within your current custodial account (if feasible) or you will be assisted with transferring your assets to a new custodial account (if necessary) where they will be managed. You will then be provided with seamless instructions on how you can constantly monitor your account moving forward.

We will be constantly evaluating ways to improve and expedite this whole process using the latest technology among the rapidly expanding list of custodians we partner with.

Professional Investors and Registered Investment Advisors (RIA’s) will have the option to seamlessly self-manage (or advise upon) designated portions their client’s assets utilizing our strategies (with our on-going guidance). We will schedule a consultation between you and your assigned registered investment advisor who will take you through the various options of managing (or advising upon) your client's assets with MG Asset Management (functioning as a sub-advisor). We will then sign an agreement with you and work closely with you after determining your optimal configuration. Our highly competitive fee structure will be based upon how much assets under management (AUM) or assets under advisement (AUA) you are managing (or advising upon) utilizing our strategies.