All-Weather Balanced

Our All-Weather Balanced Strategy is our slightly more moderately positioned collaborative effort, carefully formulated to outperform within all market cycles.

The Wealth Quorum®, in cooperation with our colleagues at MG Asset Management, have co-developed our All-Weather Balanced Strategy.

This slightly more moderately positioned, risk-managed growth strategy is carefully formulated to significantly outperform within all market cycles.

This resilient strategy offers a blended composition of our slightly more moderately performing components, but with a comfortable “balance” emphasized in its composition along with a strong emphasis placed upon our newly conceptualized “in and out” method. This revolutionary system is designed to optimally navigate market ups and downs and significantly reduce volatility and drawdowns. Our “All-Weather” approach is an effective portfolio solution that incorporates different investment strategies (edges) and various tactical and adaptive algorithms that are structured to work together to produce positive risk-adjusted performance in bullish markets and provide defensive, risk-averse performance in unfavorable stock environments.

This strategy is available to both our individual and professional Members and offers unprecedented flexibility and customization. Members who wish to participate will enjoy the ability to employ unlimited levels of capital that can best suit their needs, coupled with some of the most competitive fees available in the industry. Individual Members may choose to have their accounts executed through any of our growing network of top custodians, including leading companies such as Schwab and Interactive Brokers. We are in the process of rapidly expanding these choices to offer our Members maximized convenience. In addition, professional Members have the option of receiving signals directly from us so they can execute their transactions through any custodian of their choice.

THE COMPONENTS

Balanced Growth in this strategy is achieved with the imposition of a large array of individual investment strategies including Global Macro ETFs with exposure to commodities, interest rates, international equities, leading market sector ETFs, global thematic ETFs, and inverse ETFs.

In addition, large cap, mid cap, and small cap stocks with market leading momentum in both earnings and price performance as well as leading Nasdaq performers are also selectively employed.

Tactical trading of US equity index ETFs based on algorithmic models of market internals and sentiment are also considered.

Finally, the Wealth Quorum® Core Strategies may also be selectively employed at optimal times based on market conditions.

Enhanced fixed income returns are achieved in this strategy with the assistance of several outside veteran fixed income managers (Clearstead and Boyd Watterson) with combined assets under management (AUM) of over $50 billion (USD).

These managers have extensive experience managing high yield disciplines. These investments include high yield, corporate and short duration ETFs as well as limited short duration higher yielding corporate bonds.

This Balanced Growth strategy employs several investment methodologies and is diversified across many different asset classes including equities, fixed income, ETFs with exposure to commodities, interest rates, international equities, leading market sector ETFs, global thematic ETFs, and inverse ETFs.

Each investment methodology has its own process for identifying opportunities, and all employ MG Asset Management’s proven tactical risk-managed trading systems for capturing alpha in the market segments they specialize in.

The Diverse Investment Methodologies Generating Alpha Within This Strategy:

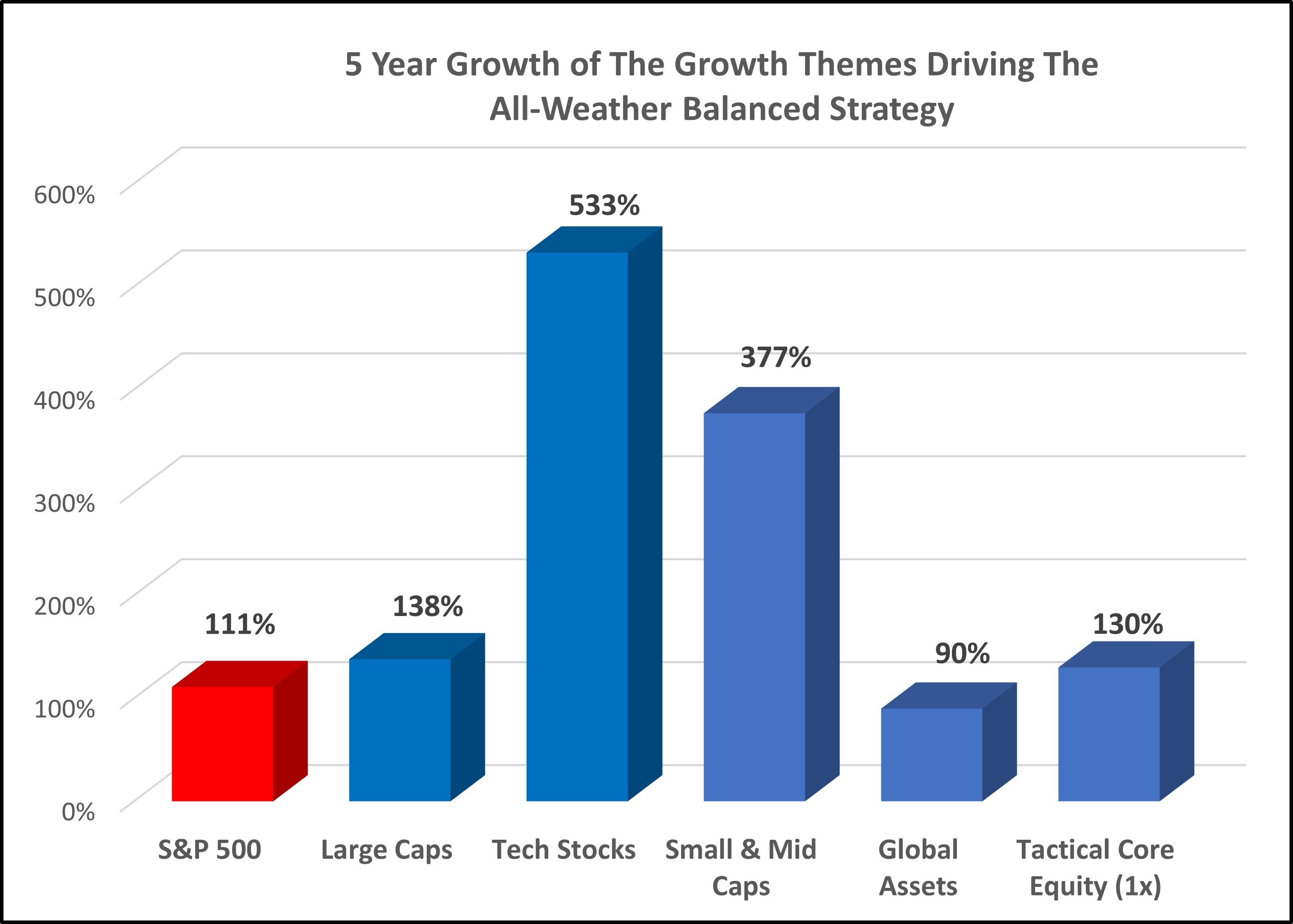

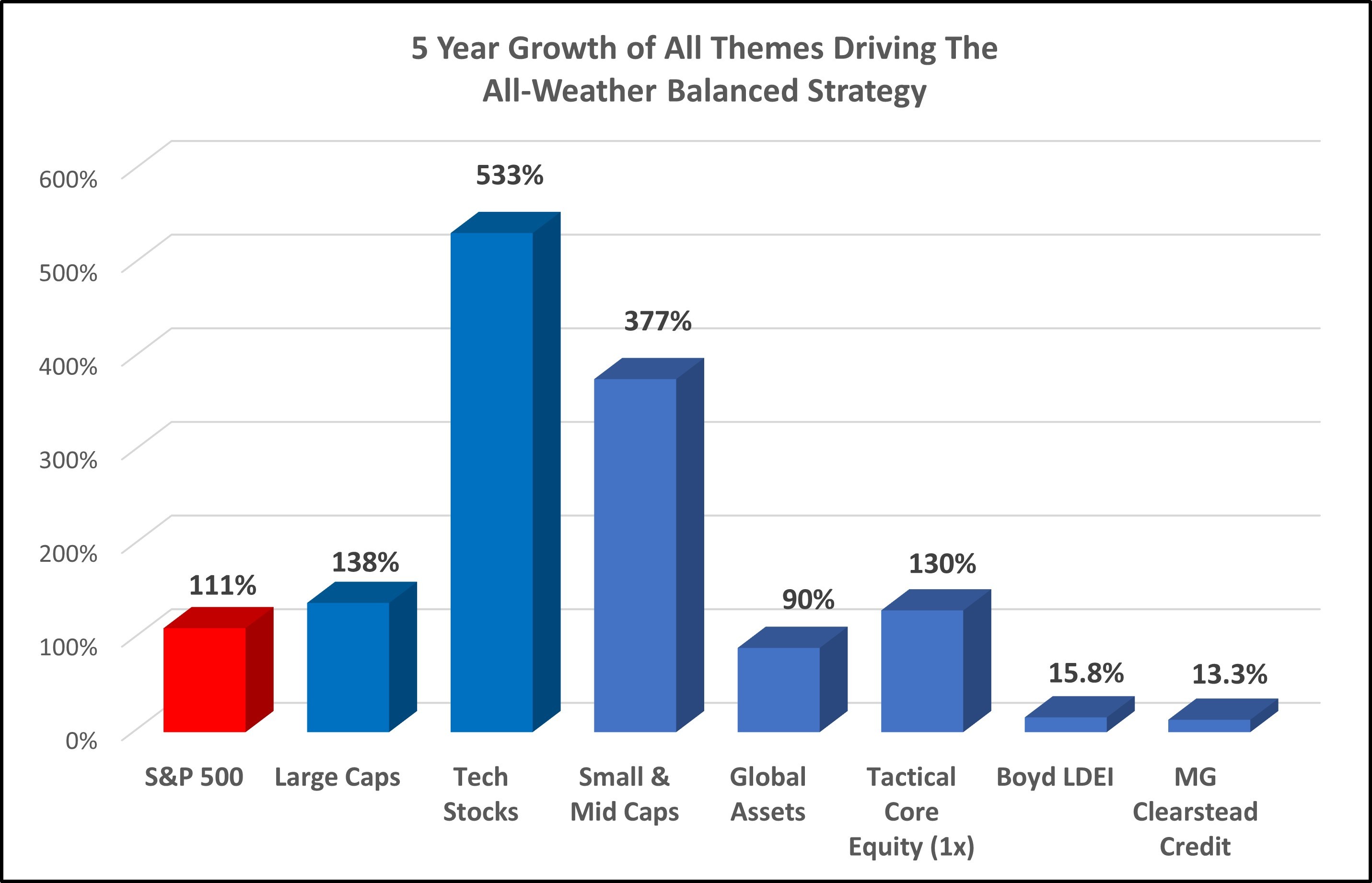

- Large Cap Equity: Stocks in this market theme represent the S&P 500’s leading stocks based on MG Asset Management’s proprietary momentum indicators and seasonally advantageous holding periods.

- Large Cap Tech Equity: Stocks in this theme represent the Nasdaq 100’s leading stocks based on MG Asset Management’s proprietary momentum indicators and seasonally advantageous holding periods.

- Small & Mid Cap Equity: This theme holds stocks with a strong earnings growth history and market leading short-term and intermediate-term price momentum. The factors used for trade identification have proven to provide impressive performance that neither correlated nor dependent on small cap or mid cap benchmarks.

- Global Asset Rotation: This theme uses ETFs to actively invest in global macro trends such as regional equities, precious metals, soft commodities, energy, bonds, currencies, and more. The methodology invests in the leading trends based MG Asset Management’s proprietary trend strength and momentum indicators.

- Tactical Core Equity: This unique methodology compliments any portfolio seeking alpha to outperform in bullish trending market environments while reducing exposure and drawdowns in negative volatility periods. This methodology actively invests in S&P 500 and Long Treasury Bond related ETFs. Its unusual trade selection process identifies opportunities using proprietary algorithms evaluating market internals data (market advances/declines, highs/lows, volatility measures, etc). As a result of Its consistently low drawdowns, it offers the opportunity to provide leverage-enhanced returns while maintaining drawdowns that are less than the unleveraged benchmark.

These growth components of the portfolio employ tactical portfolio management centered around risk-managed strategies that deliver consistent outperformance with lower drawdowns.

As a result, these methodologies have significantly outperformed the S&P 500 over the last five years, as shown in the chart below.

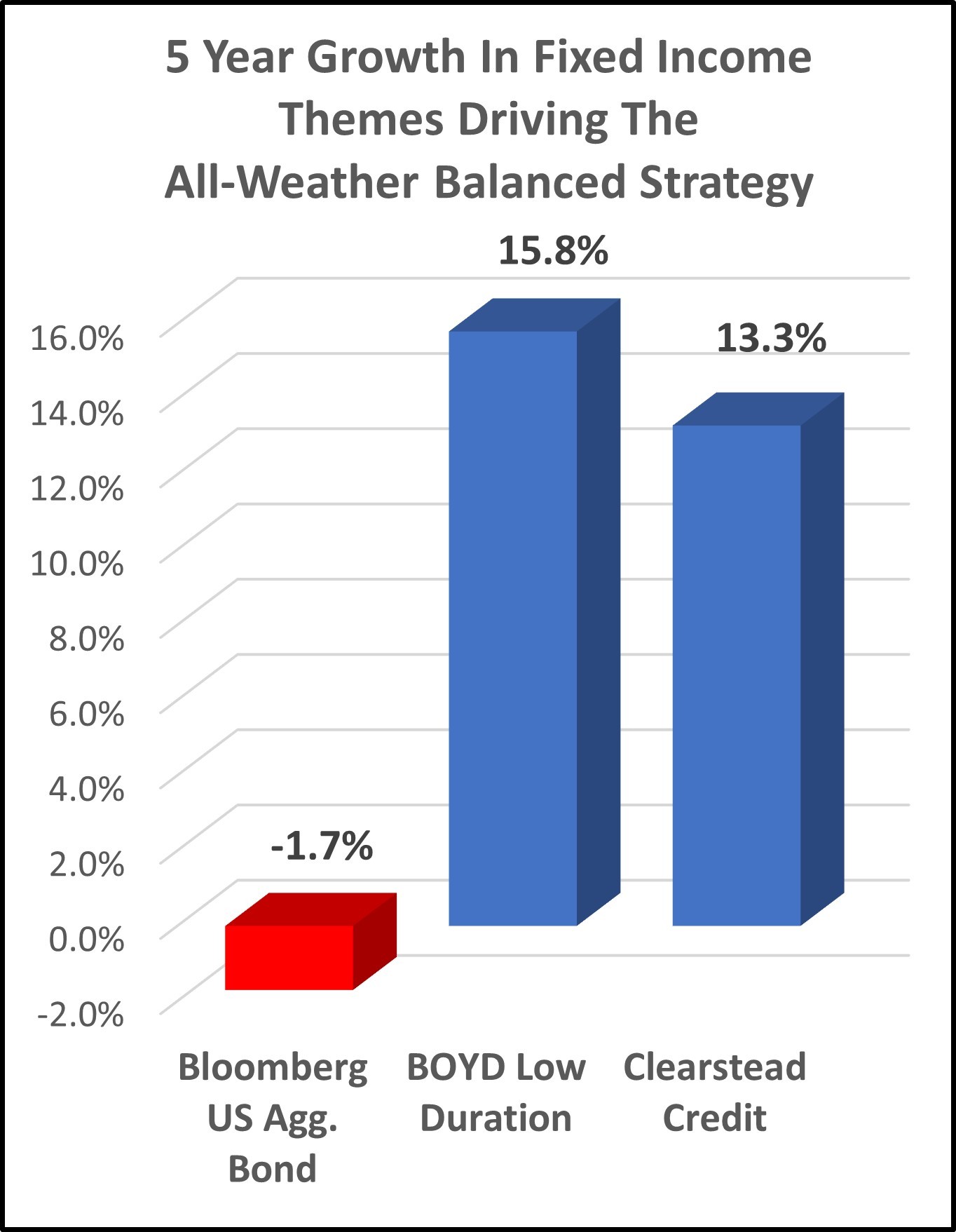

The Fixed Income Methodologies Providing Balance for The Portfolio:

The income strategy uses a disciplined, tactical approach to fixed income investing. Our strategy incorporates two outside, veteran, fixed income managers who have extensive experience managing high yield disciplines. One Manager, Clearstead, utilizes a tactical approach incorporating high yield, corporate, and short-duration ETFs. The other, Boyd Watterson, utilizes limited short duration higher yielding corporate bonds (130 typically in the portfolio) and tactically adjusts based on an extensive macro-economic and fixed income market orientation.

These bonds typically have lower volatility with enhanced yields.

This consistent outperformance with lower drawdowns drives the compounded returns you’ll see in the chart provided below.

The All-Weather Balanced Strategy exemplifies our attention to tactical portfolio management centered around risk-managed strategies in both growth and fixed income methodologies to deliver consistent outperformance with lower drawdowns.

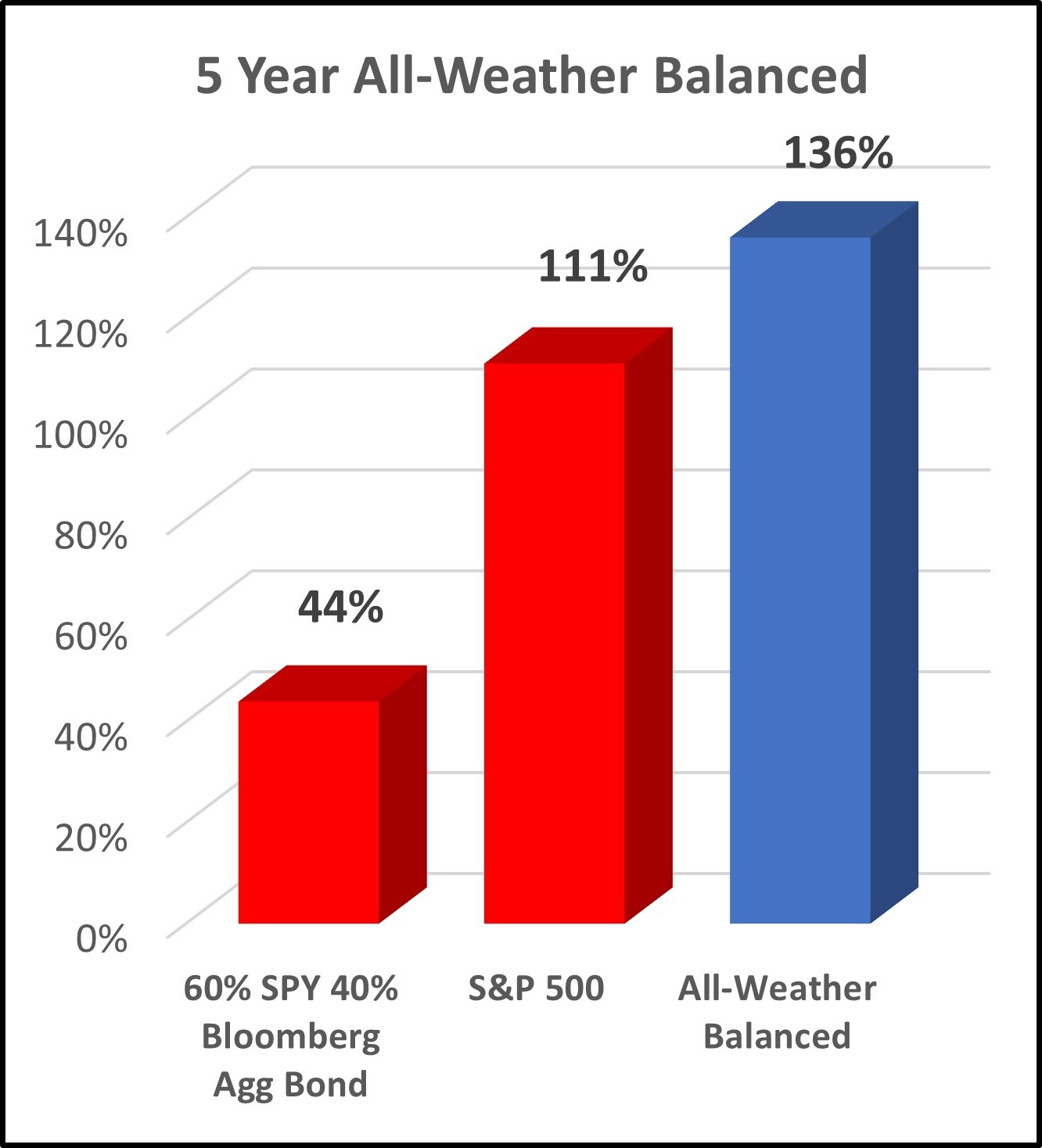

In the last 5 years, the S&P 500 and the 60/40 Portfolio have had average annual rates of return of 13.5% and 6.8% respectively. In the same period, our All Weather Balanced Strategy has had an average annual rate of return of 14.7%.

THE ONBOARDING PROCESS

The very first step in the process is to contact us directly and schedule a brief consultation directly with our Managing Director, Clayton Anderson. During this brief call, it will be determined which onboarding process is likely most suitable for your needs. Mr. Anderson will then refer you directly to our team of onboarding professionals who will carefully examine your unique situation and guide you through the remainder of the process in the most seamless and expedited fashion possible.

Individual Investors will be seamlessly guided through a simple 3-step onboarding process.

1) First, a consultation will be scheduled with one of our registered investment advisors with our partners at MG Asset Management. During this consultation, your advisor will help you both determine and confirm your suitability for your desired strategy selection. Your advisor will then help you determine the optimal options for who will serve as the designated custodian for your assets. This could include an existing relationship you already have established or one that your advisor suggests. Your advisor will then prepare and explain all the necessary agreements to establish the relationship between yourself and MG Asset Management.

2) Second, your advisor will prepare, explain and execute all the necessary agreements between yourself, the custodian of choice and MG Asset Management.

3) Finally, your advisor will begin professionally managing your assets within your current custodial account (if feasible) or you will be assisted with transferring your assets to a new custodial account (if necessary) where they will be managed. You will then be provided with seamless instructions on how you can constantly monitor your account moving forward.

We will be constantly evaluating ways to improve and expedite this whole process using the latest technology among the rapidly expanding list of custodians we partner with.

Professional Investors and Registered Investment Advisors (RIA’s) will have the option to seamlessly self-manage (or advise upon) designated portions their client’s assets utilizing our strategies (with our on-going guidance). We will schedule a consultation between you and your assigned registered investment advisor who will take you through the various options of managing (or advising upon) your client's assets with MG Asset Management (functioning as a sub-advisor). We will then sign an agreement with you and work closely with you after determining your optimal configuration. Our highly competitive fee structure will be based upon how much assets under management (AUM) or assets under advisement (AUA) you are managing (or advising upon) utilizing our strategies.